Fiscal Drag: Caught in the 60% tax trap?

The number of taxpayers caught in the 60% tax trap has increased by nearly 25% over the past year. More than 500,000 people are now affected by higher tax rates due to their income exceeding £100,000.

The 60% rate applies to income between £100,000 and £125,140. This is the tranche of income which sees the £12,570 personal allowance tapered away.

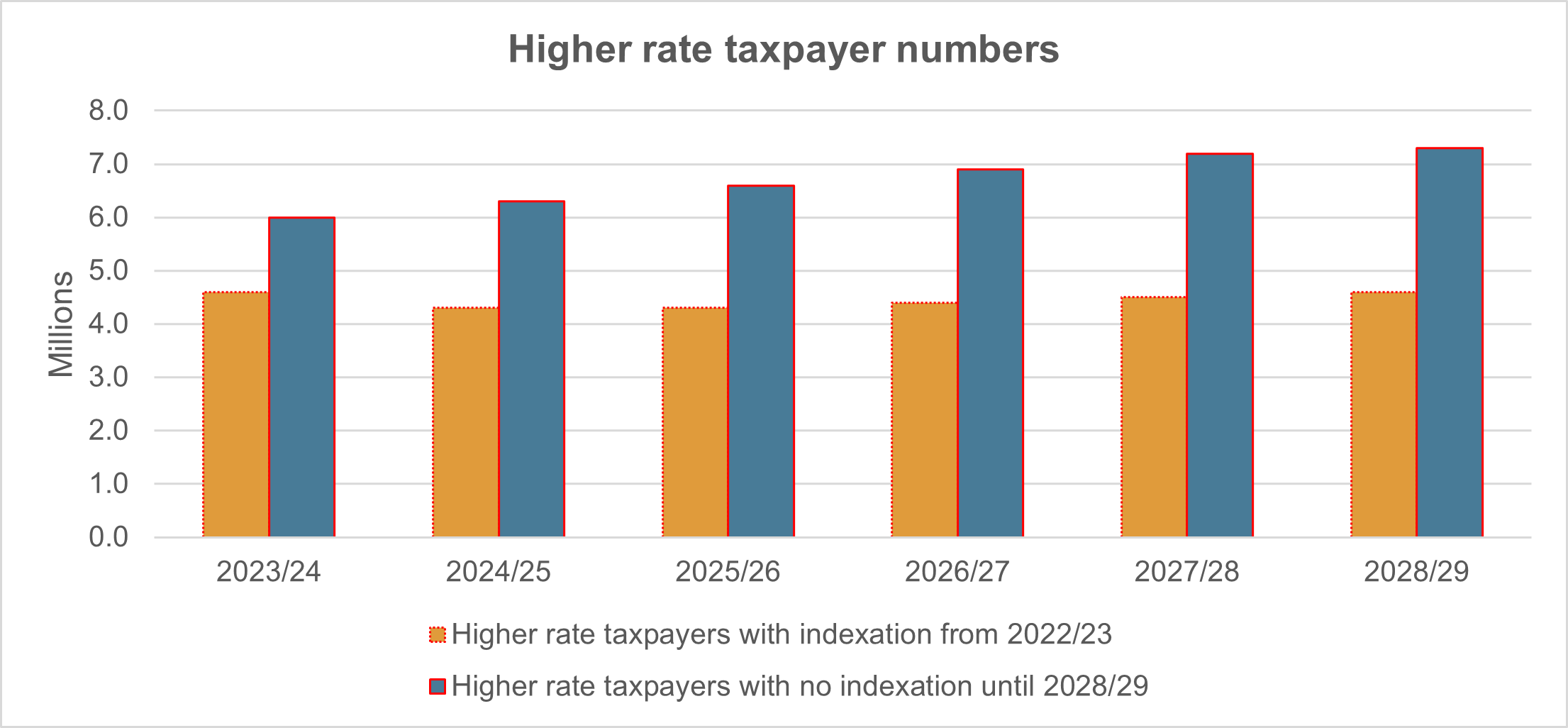

Fiscal drag

There has been no change in the £100,000 income limit since the withdrawal of the personal allowance was introduced in 2010, a classic case of fiscal drag. Once the personal allowance is fully withdrawn, higher earners pay the additional rate of 45% on income in excess of £125,140. However, the 60% charge still applies to income between £100,000 and £125,140.

The past year has seen a particularly high increase in individuals caught by the 60% tax trap due to inflation driving up salaries. The government is unlikely to fix the problem by reinstating the personal allowance for higher earners – the cost would be prohibitive. However, smoothing the transition is a possibility. For example, tapering the personal allowance by £1 for every £4 (rather than £2) that income exceeds £100,000 would reduce the 60% tax rate to a rate of 50%.

Planning measures

Measures that can be taken to mitigate the 60% tax trap vary from individual to individual:

- Pension contributions are particularly attractive if the government is funding 60% of the cost. Be warned, however, that the October Budget might see the tax relief given on pension contributions restricted to a flat rate.

- Some income reallocations might be possible between spouses and civil partners, especially if they are in business together.

- Make the best use of tax-free investments to turn taxable investment income into non-taxable income.

- Be mindful of the timing when cashing in investment bonds or making pension withdrawals.

Employees should consider using a salary sacrifice arrangement for pension contributions or low-emission company cars.

Details of income tax rates and personal allowances for the current tax year can be found on the government website here.

Photo by irfan hakim on Unsplash