High Income Child Benefit Charge: penalties and defaults

New data reveals that penalties issued by HMRC for not paying the High-Income Child Benefit Charge (HICBC), or paying the incorrect amount, have fallen significantly. However, the number of individuals still in default is estimated at more than 60,000.

If the HICBC is payable, an individual is required to submit a self-assessment tax return each year even if all of their income is taxed through PAYE.

- Such individuals are unlikely to receive professional advice, so there is a lack of awareness.

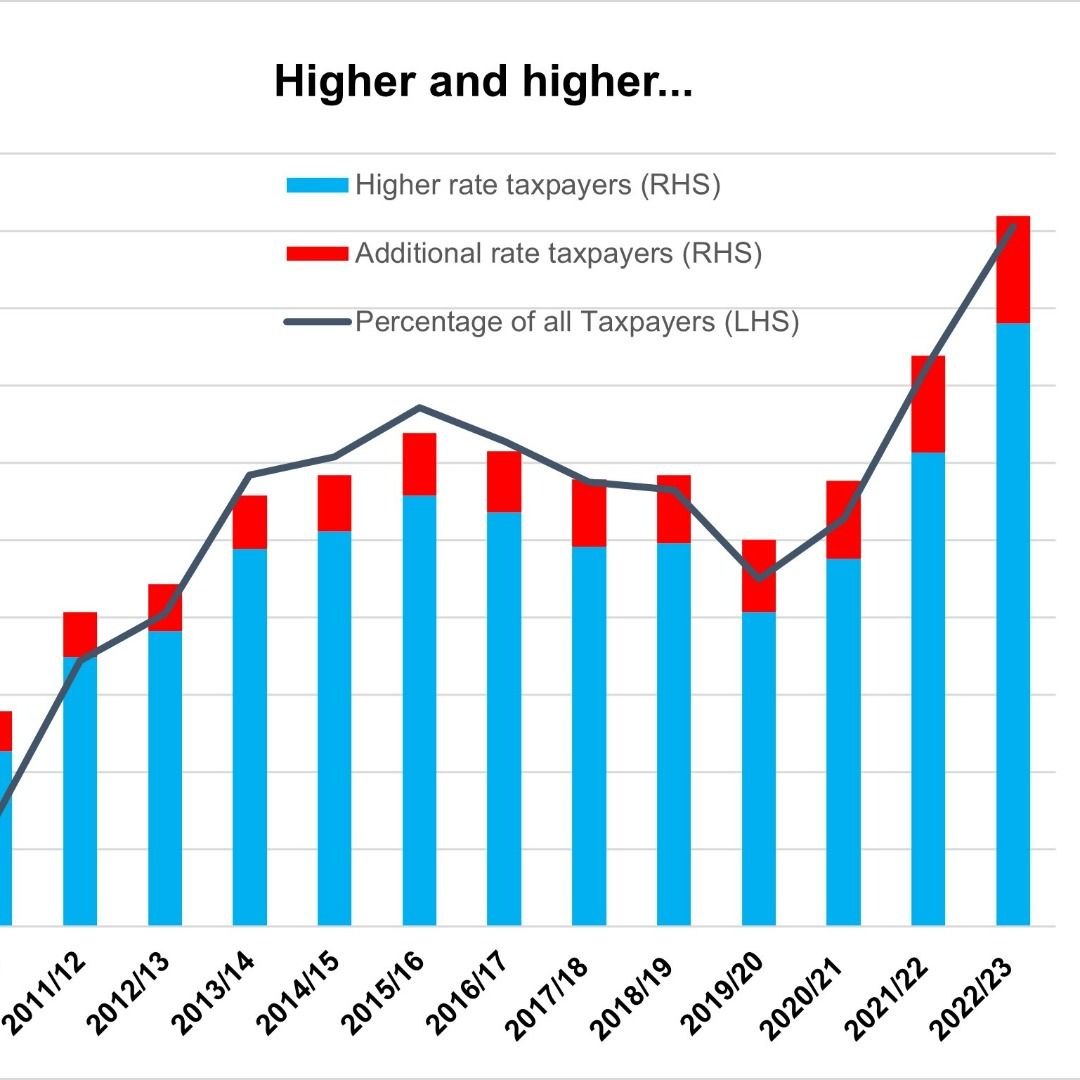

- Salary increases can lead to someone becoming subject to the charge, especially as the income limit has remained at £50,000 since the charge was introduced.

Complications

The HICBC can apply if either partner has income over £50,000. The definition of a partnership for this purpose includes people living together.

The charge falls on the partner with the higher income, and in many cases, one partner will not know what the other partner’s income is, especially if they have separated.

Although child benefit is normally paid to the person the child is living with, it is possible for the other partner to make the claim if they are contributing at least as much as the amount of the child benefit towards the child’s upkeep.

Moving in or out

Where a partner (B) moves in or out (with partner A) the position is:

- Partner B moves in: Partner A could become liable to the HICBC, but only from when partner B moved in. Partner B will take over partner A’s HICBC if they have the higher income.

- Partner B moves out: If partner A has the higher income, they will only be liable for the HICBC up to the date partner B moves out.

Self-assessment

Given the 31 January deadline for filing the 2021/22 tax return, individuals should urgently review their situation to ensure any HICBC is correctly declared. This is also the deadline for amending the 2020/21 return without the need to write to HMRC.

Failure to pay the HICBC, or paying the incorrect amount, will mean backdated assessments, often for considerable sums, plus, if no reasonable excuse, late notification penalties.

HMRC’s basic guide to the HICBC can be found here.