Friday Afternoon Meanderings; What Is The Future of The Company Car Benefit?

It’s not often I get nostalgic, but every once in a while, I harken back to my days in the Revenue (now “HMRC”) and in practice as a tax consultant; to a time when the company car was the fringe benefit that every employee wanted. As my somewhat fuzzy memory recalls, you had ‘made it’ once you had the keys to a car with no worries about servicing, insuring or, sometimes, even fuel costs. It could also make plenty of tax sense, as the cost of the car was not fully reflected in the amount on which tax was charged. Go back far enough and two company cars were not uncommon for some senior executives.

Unsurprisingly, the days of company cars as tax-efficient remuneration have largely passed, other than for electric vehicles. The government approach to company cars brings to mind the comment of Jean-Batiste Colbert, a 17th century French Minister of Finance, who said “the art of taxation consists in so plucking the goose as to procure the largest quantity of feathers with the least possible amount of hissing”.

Some 400 years later, successive UK chancellors have steadily notched up the company car benefit scales to raise additional revenue from a stable to shrinking number of company car drivers. For example, the latest HMRC data show that between 2010/11 and 2018/19, the average company car taxable value has risen by 57% against a 19% increase in inflation over the same period.

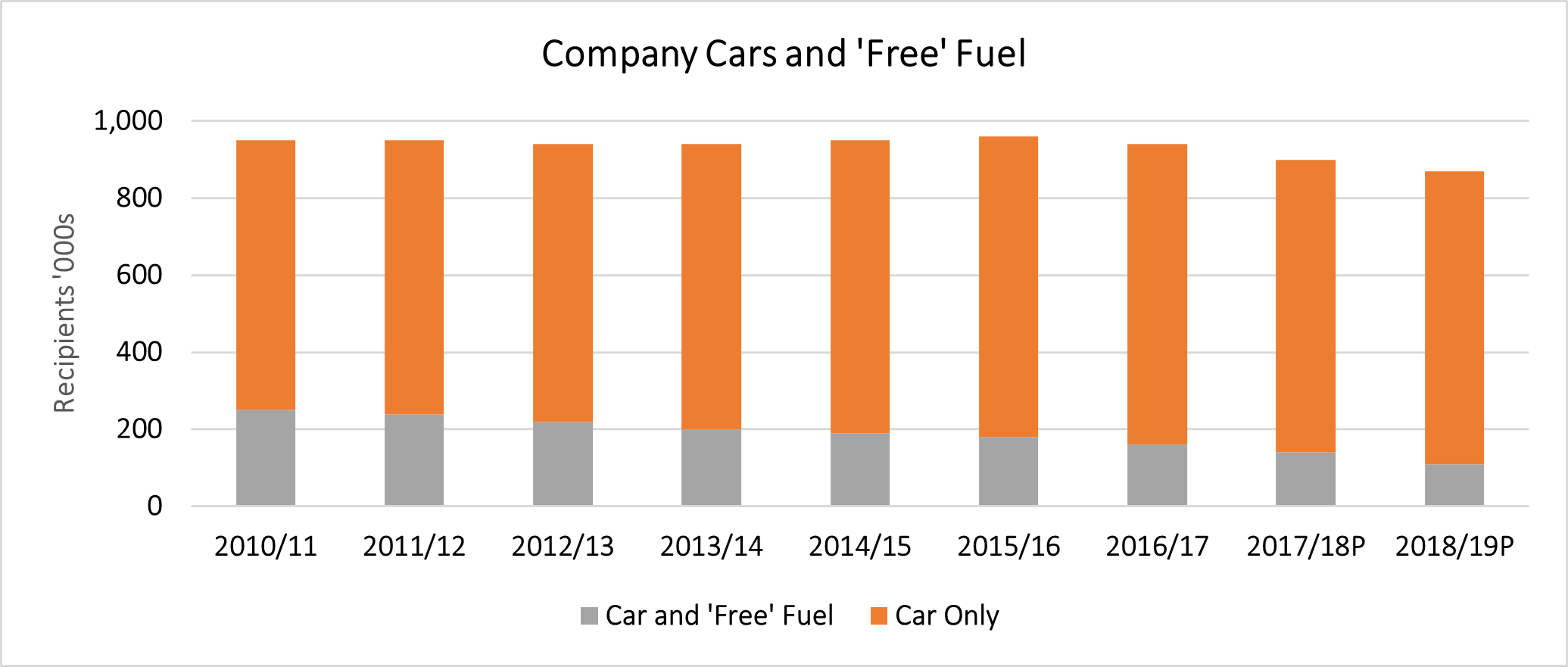

Similarly, the taxable value of ‘free’ fuel (i.e. employer-funded fuel) has risen by 44%. As the graph shows, the popularity of ‘free’ fuel has steadily fallen – only about one in eight company car drivers now pays nothing to fill up their tank. If you are one of that minority, do make sure you have enough private mileage to justify the tax you pay. The main reason for the drop in ‘free’ fuel numbers is that for many employees, the tax bill would be greater than their personal refuelling cost.

The gradual demise of the company car is a lesson in how the tax system can subtly alter over time. A major revamp in the treatment of salary sacrifice schemes introduced in 2017 changed the tax landscape for other fringe benefits, too. The one that has survived and still remains attractive – at least for now – is salary sacrifice to fund pension contributions.

Source: HMRC September 2020